|

NB: The Internal Measurements of a 20' Hi-Cube Shipping Container is, 5898*2350*2680mm.

Is DAP the Same as DDU?

Delivered-at-Place (DAP) was introduced in 2010 to Replace the term Delivered Duty Unpaid (DDU) so they're essentially the same. 5

Delivered At Place (DAP) vs. Delivered Duty Paid (DDP)

Delivered At Place (DAP) means that it's the Customer's responsibility to pay for the destination Country's Customs charges, duties, or taxes. These must all be paid for Customs to release the shipment after it arrives & Unpacked.

Delivered Duty Paid (DDP) means that it's the Shipper's responsibility to pay any of the Customs charges, duties, and/or taxes that are required to send the product to the destination country.

Advantages and Disadvantages of DAP

The primary benefit of Delivered At Place (DAP) shipping is that it gives the buyer more control over the shipping procedures. Having a higher degree of control over the process can be paramount for global buyers looking to keep a consistent flow of inventory.

Controlling costs and tracking shipments are typically easier under DAP shipping than in DDP shipping. Buyers are naturally more knowledgeable of their own country's shipping customs.

From the seller's perspective, DAP shipping provides the ability to take more of a "hands-off" approach when it comes to the destination country's shipping rules. The seller is simply responsible for getting the cargo to its destination where the buyer can handle all the legal complications.

There are also disadvantages to DAP shipping. The biggest problem for buyers is the possibility of surprise duties or tax charges when their shipment finally arrives. That's a big negative for buyers but it's not ideal for shippers either because disgruntled customers may refuse to pay for their parcel to be delivered.

Is DAP Shipping or DDP Shipping Better ?

There are pros and cons to each method of shipping. It ultimately boils down to what the buyer or receiver wants out of their shipping experience.

DAP is a good option if the receiver prioritizes control of the shipping process and doesn't mind the legal complications or surprise charges that come with more control. But DDP is probably the way to go if a buyer wants a streamlined process without the possibility of any surprise charges.

Who Is Responsible for DAP Shipments ?

The seller is fully responsible for the delivery of the goods to the destination country under DAP shipping rules. The seller assumes all risks involved up to unloading. The buyer bears the risk and cost of the unloading.

Responsibilities Under DAP

The seller secures licenses and takes care of other formalities involved in exporting a good according to DAP arrangements. It's also responsible for all licenses and costs incurred in transit countries as well as for providing an invoice at its own cost.

The seller assumes all risk until the goods are delivered to the specified location but it has no obligation to obtain insurance on the goods.

The buyer is responsible for obtaining all necessary licenses for importing the goods and paying all relevant taxes, duties, and inspection costs. All risks involved in this process are borne by the buyer. All further transportation costs and risks fall on the buyer when the goods are placed at the disposal of the buyer.

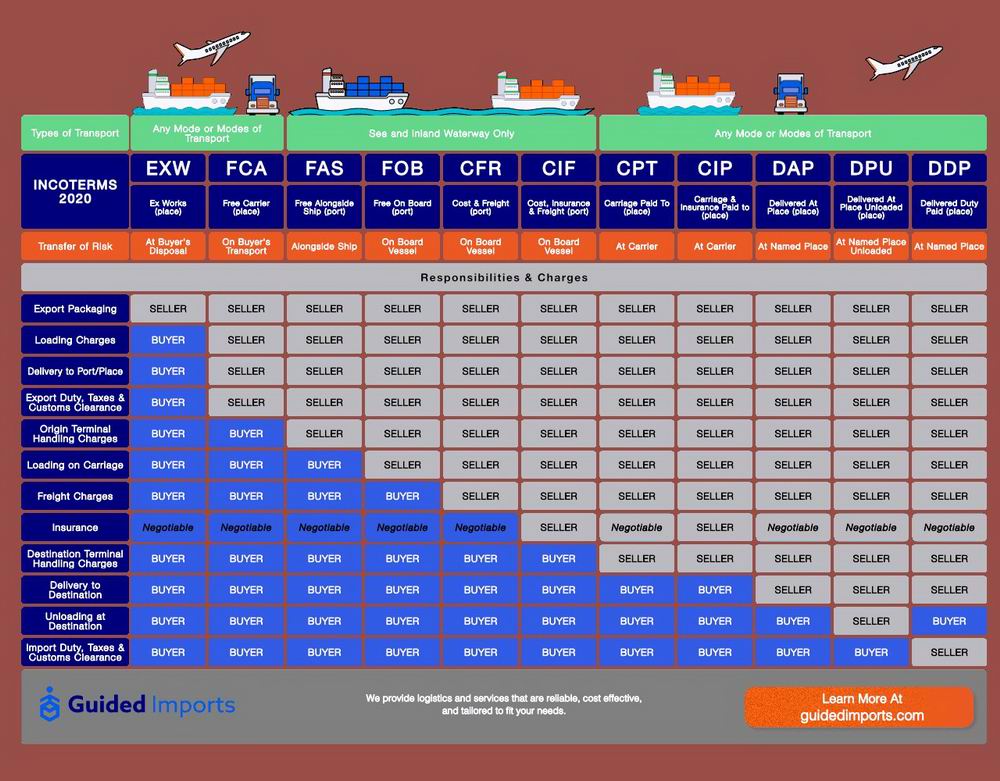

| Seller Obligations vs. Buyer Obligations Under DAP |

| Seller Obligations |

Buyer Obligations |

| Delivers the goods, as well as the documentation that proves the buyer can take legal possession of them. |

Pays for the delivered goods. |

| Responsible for all documentation required to export the goods. |

Responsible for all documentation required for import clearance when the shipment has arrived. |

| Once the goods are delivered to the destination country, all risk is transferred to the buyer. |

Once the goods are delivered alongside the ship, the buyer is responsible for any loss or damage from that point on. |

| Seller pays for the delivery, loading, labour, and transportation costs up to the destination country. |

Buyer pays for the import duties and taxes, customs charges, unloading costs, and delivery costs to their own warehouses. |

The Bottom Line

From the seller's perspective, DAP shipping provides the ability to take more of a "hands-off" approach when it comes to the destination country's shipping rules. The biggest problem for buyers in DAP shipping is the possibility of surprise duties and/or tax charges when their shipment finally arrives. The term "Delivered-at-Place (DAP) has been used in place of DAP since 2010. Look for this updated term if you have questions regarding shipments or deliveries.

--- /// ---

Notes for Above:

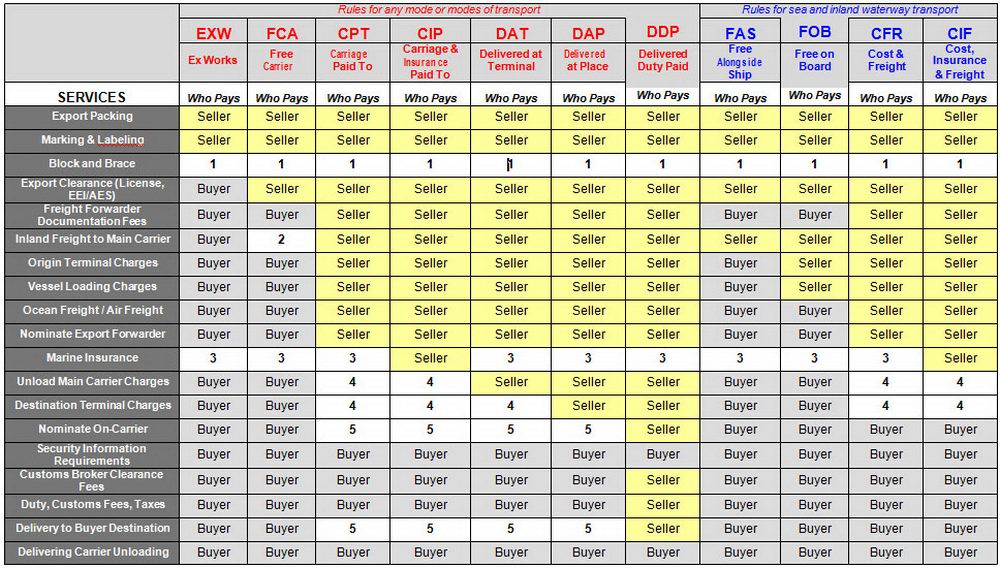

1 – Incoterms® 2010 do not deal with the parties' obligations for stowage within a container and therefore, where relevant, the parties should deal with this in the sales contract.

2 – FCA Seller's Facility – Buyer pays inland freight; other FCA qualifiers. Seller arranges and loads pre-carriage carrier and pays inland freight to the "F" delivery place

3 – Incoterms® 2010 does not obligate the buyer nor must the seller to insure the goods, therefore this issue be addressed elsewhere in the sales contract.

4 – Charges paid by Buyer or Seller depending on contract of carriage.

5 – Charges paid by Seller if through Bill of Lading or door-to-door rate to Buyer's destination.

INCOTERMS® IS A REGISTERED TRADEMARK OF THE INTERNATIONAL CHAMBER OF COMMERCE. THIS DOCUMENT IS NOT INTENDED AS LEGAL ADVICE BUT IS BEING PROVIDED FOR REFERENCE PURPOSES ONLY. USERS SHOULD SEEK SPECIFIC GUIDANCE FROM INCOTERMS® 2010 AVAILABLE THROUGH THE INTERNATIONAL CHAMBER OF COMMERCE

INCOTERMS – 2010 DEFENISIONS

EXW – Ex Works (named place of loading)

The seller makes the goods available at their premises. This term places the maximum obligation on the buyer and minimum obligations on the seller. The Ex Works term is often used when making an initial quotation for the sale of goods without any costs included. EXW means that a buyer incurs the risks for bringing the goods to their final destination. Either the seller does not load the goods on collecting vehicles and does not clear them for export, or if the seller does load the goods, he does so at buyer's risk and cost. If parties wish seller to be responsible for the loading of the goods on departure and to bear the risk and all costs of such loading, this must be made clear by adding explicit wording to this effect in the contract of sale.

The buyer arranges the pickup of the freight from the supplier's designated ship site, owns the in-transit freight, and is responsible for clearing the goods through Customs. The buyer is also responsible for completing all the export documentation.

These documentary requirements may cause two principal issues. Firstly, the stipulation for the buyer to complete the export declaration can be an issue in certain jurisdictions (not least the European Union) where the customs regulations require the declarator to be either an individual or corporation resident within the jurisdiction. Secondly, most jurisdictions require companies to provide proof of export for tax purposes. In an Ex Works shipment, the buyer is under no obligation to provide such proof, or indeed to even export the goods. It is therefore of utmost importance that these matters are discussed with the buyer before the contract is agreed. It may well be that another Incoterm, such as FCA seller's premises, may be more suitable.

FCA – Free Carrier (named place of delivery)

The seller delivers the goods, cleared for export, at a named place. This can be to a carrier nominated by the buyer, or to another party nominated by the buyer.

It should be noted that the chosen place of delivery has an impact on the obligations of loading and unloading the goods at that place. If delivery occurs at the seller's premises, the seller is responsible for loading the goods on to the buyer's carrier. However, if delivery occurs at any other place, the seller is deemed to have delivered the goods once their transport has arrived at the named place; the buyer is responsible for both unloading the goods and loading them onto their own carrier.

CPT – Carriage Paid To (named place of destination)

CPT replaces the venerable C&F (cost and freight) and CFR terms for all shipping modes outside of non-containerized sea freight.

The seller pays for the carriage of the goods up to the named place of destination. Risk transfers to buyer upon handing goods over to the first carrier at the place of shipment in the country of Export. The seller is responsible for origin costs including export clearance and freight costs for carriage to named place of destination (either final destination such as buyer's facilities or port of destination has to be agreed by seller and buyer, however, named place of destination is generally picked due to cost impacts). If the buyer does require the seller to obtain insurance, the Incoterm CIP should be considered.

CIP – Carriage and Insurance Paid to (named place of destination)

This term is broadly similar to the above CPT term, with the exception that the seller is required to obtain insurance for the goods while in transit. CIP requires the seller to insure the goods for 110% of their value under at least the minimum cover of the Institute Cargo Clauses of the Institute of London Underwriters (which would be Institute Cargo Clauses (C)), or any similar set of clauses. The policy should be in the same currency as the contract.

CIP can be used for all modes of transport, whereas the equivalent term CIF can only be used for non-containerized sea freight.

DDP – Delivered Duty Paid (named place of destination)

Seller is responsible for delivering the goods to the named place in the country of the buyer, and pays all costs in bringing the goods to the destination including import duties and taxes. The seller is not responsible for unloading. This term is often used in place of the non-Incoterm "Free In Store (FIS)". This term places the maximum obligations on the seller and minimum obligations on the buyer. With the delivery at the named place of destination all the risks and responsibilities are transferred to the buyer and it is considered that the seller has completed his obligations

DAP – Delivered At Place (named place of destination)

This term means that the seller delivers the goods to the buyer to the named place of destination in the contract of sale. A transaction in international trade where the seller is responsible for making a safe delivery of goods to a named destination, paying all transportation expenses but not the duty. The seller bears the risks and costs associated with supplying the goods to the delivery location, where the buyer becomes responsible for paying the duty and other customs clearing expenses.

FAS – Free Alongside Ship (named port of shipment)

The seller delivers when the goods are placed alongside the buyer's vessel at the named port of shipment. This means that the buyer has to bear all costs and risks of loss of or damage to the goods from that moment. The FAS term requires the seller to clear the goods for export, which is a reversal from previous Incoterms versions that required the buyer to arrange for export clearance. However, if the parties wish the buyer to clear the goods for export, this should be made clear by adding explicit wording to this effect in the contract of sale. This term can be used only for sea or inland waterway transport [7]

FOB – Free on Board (named port of shipment)

FOB means that the seller pays for delivery of goods to the vessel including loading. The seller must also arrange for export clearance. The buyer pays cost of marine freight transportation, bill of lading fees, insurance, unloading and transportation cost from the arrival port to destination. The buyer arranges for the vessel, and the shipper must load the goods onto the named vessel at the named port of shipment according to the dates stipulated in the contract of sale as informed by the buyer. Risk passes from the seller to the buyer when the goods are loaded aboard the vessel.

CFR – Cost and Freight (named port of destination)

The seller pays for the carriage of the goods up to the named port of destination. Risk transfers to buyer when the goods have been loaded on board the ship in the country of Export. The Shipper is responsible for origin costs including export clearance and freight costs for carriage to named port. The shipper is not responsible for delivery to the final destination from the port (generally the buyer's facilities), or for buying insurance. If the buyer does require the seller to obtain insurance, the Incoterm CIF should be considered. CFR should only be used for non-containerized Seafreight; for all other modes of transport it should be replaced with CPT.

CIF – Cost, Insurance & Freight (named port of destination)

This term is broadly similar to the above CFR term, with the exception that the seller is required to obtain insurance for the goods while in transit to the named port of destination. CIF requires the seller to insure the goods for 110% of their value under at least the minimum cover of the Institute Cargo Clauses of the Institute of London Underwriters (which would be Institute Cargo Clauses (C)), or any similar set of clauses. The policy should be in the same currency as the contract. CIF can be used by any transport by sea and air not limited to containerized or non-containerized cargo and includes all charges up to the port/terminal of entrance. CIP covers additional charges at the port/terminal of entrance. |